What is a corporate credit rating

Corporate credit rating is a certificate that shows the centralized presentation of basic information about the company's external economic transactions during its ongoing operations. The corporate credit rating usually refers to the indicator level based on the credit record, performance ability, operating status, profitability, etc. of the assessment object, that is, the credit rating agency uses a predetermined symbol to identify the credit level of the entity and the level of debt risk. The higher the credit rating, the better the company's operating conditions, compliance behaviors, and credit records.

The significance and value of corporate credit rating for enterprises

Corporate Credit Ratings Eight green passes for companies in operations and marketing activities.

1. It is a reliable "quoting pass" where companies obtain government support for investment promotion, investment, financing guarantees and bank loans.

2. It is an indispensable "honor certificate" that measures corporate performance ability, tender reputation, comprehensive strength and competitiveness;

3. "Guiding evidence" that enterprises have an insight into the inevitable trend of social and economic development, and enhance modern management and internationalization.

4. "Optimization Certificate" for enterprises to improve their operation and management, strengthen the credit management system, and improve enterprise risk control.";

5. It is a "risk certificate" that enterprises increase cooperation, credit sales and contract risk prevention in their business activities;

6. It is an important intangible "property certificate" for companies to increase brand value and brand competitiveness."

7. It is an important "redemption certificate" where companies reduce their capital raising and transaction costs.

Application Criteria for Enterprise Credit Rating

1. Apply for a rating company for Chinese SMEs;

2. Legally registered enterprise legal persons and other economic organizations;

3. There are three fiscal years to be established, and there are main business incomes in the past three years. If the company is in continuous operation, non-immediately closed or stopped companies cannot be rated.

Corporate credits Assessment of required submissions

1. A copy of business license (copy), organization code certificate (copy), tax registration certificate (copy), loan card, import and export license, and registered capital verification report after annual inspection;

2. Provide a copy of the audit report of the most recent three-year annual financial report (balance sheet, profit and loss statement, cash flow statement) audited by the accounting firm; if there is no audit for the year, submit the financial statements for the last three months (assets and liabilities Table, profit and loss statement, cash flow statement);

3. Photocopies of honors such as independent intellectual property rights, trademarks, patents, licenses for qualifications, new product appraisals, scientific and technological progress awards, and product exemption certificates in recent years;

4. Various certifications passed, and related qualification certificates (such as quality management system certification, environmental system certification, etc.) and social honor/winner certificates (such as suppliers, customers, banks, industry and commerce, taxation, shareholders) Proof of copy;

5. The current organizational chart (including job descriptions for each department, job descriptions for each job position), and a list of written documents and document directories for related systems (including the company's charter, senior management incentive and restraint mechanisms);

6. Description of plans and plans for company profile, business development, product market positioning (product introduction, production, capacity, etc.), future market prospects, and development strategy (if any, please specify);

7. Other documents or materials related to the certification of corporate credit.

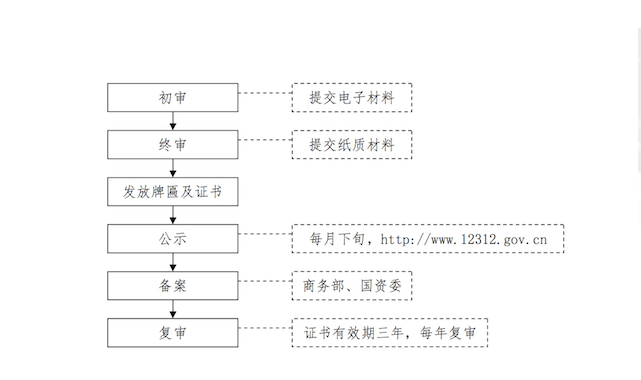

Corporate Credit Certification Process